Medicare Open Enrollment: Make Sure You're Getting the Coverage You Need

Your Guide to Making Changes to Your Coverage

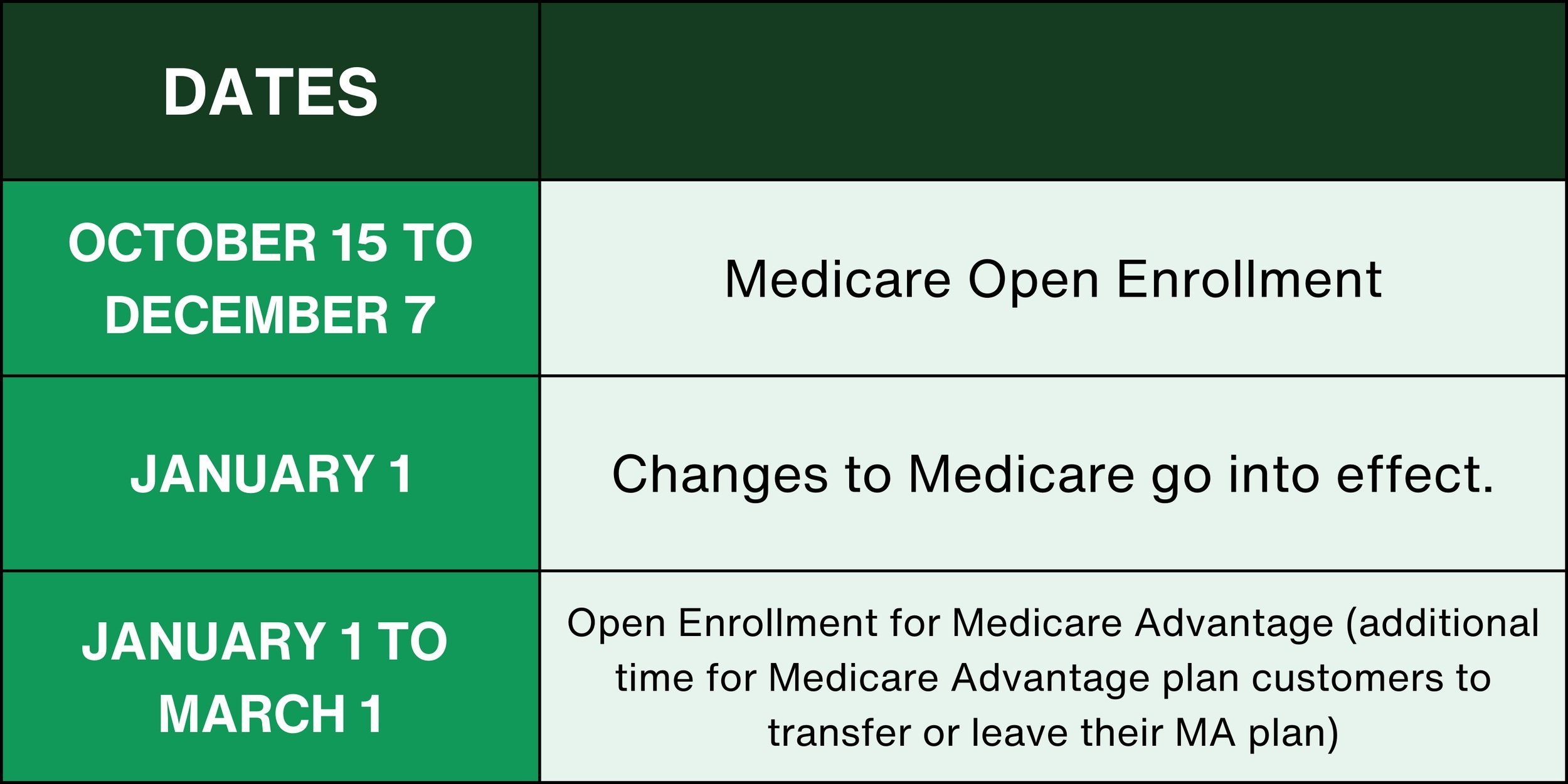

Medicare plans vary every year, as do your healthcare requirements. The Medicare Open Enrollment Period (OEP), which runs from October 15 to December 7, allows you the opportunity to examine and make adjustments to your existing Medicare coverage.

Open Enrollment Period for Medicare

also known as the Medicare Advantage and Prescription Drug Plan "annual election period" or "annual enrollment period," occurs each year from October 15 to December 7.

If the plans receive your request by December 7, coverage adjustments will take effect on January 1. This is the major time for people with Medicare to select a plan, although there are other times during the year when a person can enroll in a plan known as "open enrollment" or "special enrollment."

Changes You Can Make to Your Medicare Coverage

People who are already enrolled in Medicare can make changes to their coverage during certain times of the year.

If you are considering making changes to your Medicare coverage, it is important to compare plans and choose the one that is best for your needs.

-

Medicare Advantage plans are offered by private insurance companies and typically offer more comprehensive coverage than Original Medicare. However, MA plans may have higher premiums and out-of-pocket costs.

-

Medicare Advantage plans can either include prescription drug coverage or not. If you choose a plan without prescription drug coverage, you will need to purchase a separate Medicare Part D plan.

-

If you are not happy with your current MA plan, you can switch to a different one during the annual enrollment period (OEP). The OEP runs from October 15 to December 7 each year.

-

Medicare Part D plans offer prescription drug coverage. You can join, switch, or leave a Part D plan during the OEP or during a special enrollment period (SEP). SEPs are available for certain events, such as moving out of your service area or losing your job.

-

If you are not happy with your current Medicare plan, you can switch to a plan offered by a different private insurer. You can do this during the OEP or during a SEP.

Things to Consider During Medicare Open Enrollment

During the OEP, you should consider the following factors when making changes to your Medicare coverage.

Your Health Needs

Have your health needs changed since you last reviewed your coverage? If so, you may need to switch to a different plan that offers better coverage for your specific needs.

Your Budget

How much can you afford to spend on your Medicare premiums and out-of-pocket costs? If you're on a tight budget, you may want to consider switching to a less expensive plan.

Your Plan's network of providers

Make sure that the plan you choose has a network of providers that includes your doctors and other health care providers.

Your Lifestyle

Do you travel frequently? If so, you may want to choose a plan that has a wider network of providers in the areas you frequent.

Your Plan's customer service

Make sure that the plan you choose has good customer service in case you have any questions or problems.

Your Prescription Drug needs

Do you take prescription drugs? If so, you need to make sure that the plan you choose covers the drugs you need.

Different Parts of Medicare Available During Open Enrollment

During the Medicare Open Enrollment Period (OEP), you can enroll in or change your coverage for all 4 parts of Medicare.

Original Medicare Part A:

Hospital insurance. You may not have to pay a premium for Part A if you or your spouse paid Medicare taxes for at least 40 quarters (10 years).

Original Medicare Part B:

Medical insurance. You will pay a monthly premium for Part B, and you may also have to pay copays and deductibles.

Medicare Part C:

Medicare Advantage plans are offered by private companies and often combine Parts A, B, and D into one plan. Medicare Advantage plans may also offer additional benefits, such as dental, vision, and hearing coverage.

Medicare Part D:

Prescription drug coverage. Medicare Part D is an optional plan offered through private companies. You may need to pay a monthly premium for Part D, and you will also have to pay copays for prescription drugs.

Important Medicare enrollment dates to keep in mind

FAQs

-

You can first sign up for Medicare during your Initial Enrollment Period (IEP). Your IEP begins 3 months before the month of your 65th birthday, includes your birthday month, and continues 3 months after. For example, if you turn 65 on January 1, 2024, your IEP would run from October 1, 2023 to March 31, 2024.

It is important to sign up for Medicare during your IEP to avoid a gap in your coverage. Medicare coverage does not start until the first day of the month following your enrollment.

-

The Medicare Advantage Open Enrollment Period (OEP) is from January 1 to March 31 each year. During this time, you can make changes to your Medicare Advantage plan, such as switching to a different plan or going back to Original Medicare. You can also add or drop a Medicare Part D prescription drug plan during the OAEP.

If you are not enrolled in a Medicare Advantage plan, you cannot make changes to your Medicare coverage during the OEP. You will need to wait until the next General Enrollment Period (GEP), which runs from October 15 to December 7 each year.

-

The Medicare Supplement Open Enrollment Period is a 6-month window that starts the month you turn 65 and are enrolled in Medicare Part B. During this time, you can enroll in a Medicare Supplement plan without answering health questions.

If you apply for a Medicare Supplement plan after your open enrollment period, there is no guarantee that an insurance company will sell you a policy.

If you are under age 65 and have Medicare, you may not be able to buy a Medicare Supplement policy or the one you want until you turn 65.